2026 ACA Reporting: Forms, Instructions & Deadlines

Posted on January 22, 2026

The Affordable Care Act requires applicable large employers (ALEs)—generally those with 50 or more full-time employees—to report information to the IRS and to their full-time employees about their compliance with the employer shared responsibility (pay or play) provisions and the health care coverage they have offered (or did not offer).

Self-insured employers (regardless of size) have additional reporting responsibilities that apply to health coverage providers.

Note: Employers no longer have to automatically send Forms 1095-B and 1095-C to individuals. An employer can now post a notice on its website informing individuals that they may request a copy of the statement. The requirement to provide the statement is met as long as the notice is:

-

Clear, conspicuous, and easily accessible to all covered individuals;

-

Timely posted, which for calendar year 2025 is by March 2, 2026 and retained until October 15, 2026; and

-

Timely furnished to the individual upon request.

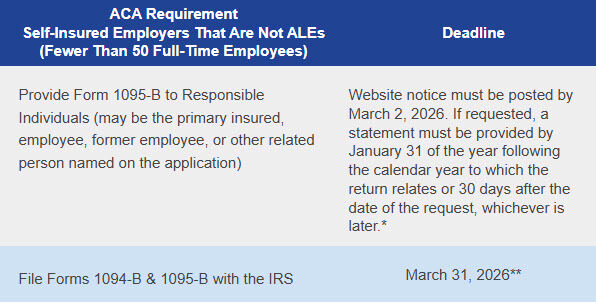

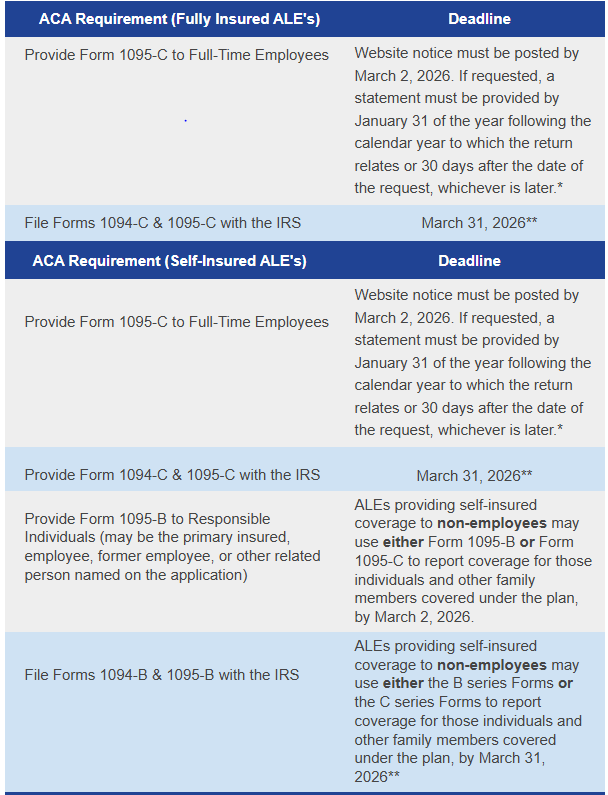

2026 filing deadlines for 2025 coverage are as follows:

Forms & Instructions

The following Internal Revenue Service (IRS) forms and instructions are available for 2025 calendar year reporting:

- Large Employer Reporting (Section 6056)

- Minimum Essential Coverage (MEC) Reporting (Section 6055)

**Reporting entities that do not wish to take advantage of the automatic furnishing method via their websites can provide Forms 1095 to full-time employees/responsible individuals by March 2, 2026. Also, reporting entities should continue to comply with applicable state reporting requirements, which may differ from federal obligations.

**This is the deadline for electronic filing. Reporting entities that file at least 10 returns during the calendar year must file electronically. Reporting entities must aggregate most information returns, such as Forms W-2 and 1099, to determine if they meet the 10-return threshold for mandatory electronic filing.